Depreciation formula example

Thus the company can take Rs. This method is used by income tax authorities for granting depreciation allowance to assesses.

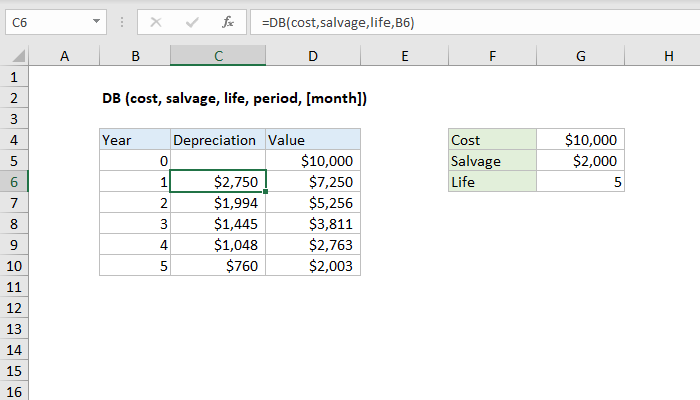

How To Use The Excel Db Function Exceljet

On 1 January 2016 XYZ Limited purchased a truck for 75000.

. The depreciation rate that is determined under such an approach is known as declining balance rate or accelerated depreciation rate. 100000 and the useful life of the machinery are 10 years and the residual value of the machinery is Rs. Profit before tax EBIT Interest expenses.

Straight Line Depreciation Formula Example 2. The straight-line depreciation formula is. Suppose the cost of asset is 1000 and rate of depreciation 10 pa.

Below is a more in-depth definition of the key terms in Earnings Before Interest Taxes Depreciation and Amortization. Calculating Depreciation Under Reducing Balance Method. Profit before tax Revenue Cost of goods sold Operating expenses Interest expenses.

For this example the fixed asset ledger entry looks like this. FCFE Formula Net Income Depreciation Depreciation Depreciation is a systematic allocation method used to account for the costs of any physical or tangible asset throughout its useful life. The calculation of depreciation under this method will be clear from the following example.

A fixed asset has an acquisition cost of LCY 100000. Formula to calculate profit before tax. Here is an example to show you how the profit before tax formula is calculated.

Formula for the Calculation of Depreciation Rate. To increase cash flows and to further increase the value of a business tax shields are used. The estimated life is eight years.

Under this method we charge a fixed percentage of depreciation on the reducing balance of the asset. Diminishing balance or Written down value or Reducing balance Method. Depreciation rate is the percentage decline in the assets value.

For example if a company has an annual depreciation of 2000 and the rate of tax is set at 10 the tax savings for the period is 200. Depreciation cost - salvage value years of useful life. The sum-of-the-years digits method is an example of depreciation in which a tangible asset like a vehicle undergoes an accelerated method of depreciation.

Under the sum-of-the-years digits method. Annual Depreciation expense 100000-20000 10 Rs. The profit before tax formula is as follows.

Tax Shield Formula. Depreciation fracCost of asset Residual valueUseful life Rate of depreciation fracAmount of depreciationOriginal cost of asset x 100. The effect of a tax shield can be determined using a formula.

For example if you buy a new oven this type of equipment naturally loses more value early in its life than it does later on. Now that we know the FCFE formula let us look at an example to calculate Free. Depreciation Tax Shield Example.

Depreciation Amount Fixed Depreciation Amount x Number of Depreciation Days 360. For example if straight line depreciation rate is 10 and the company uses a 200 of the straight line depreciation rate the accelerated depreciation rate to be used in declining balance method would be 20. Depreciation is estimated at 20 per year on the book value.

Calculating Depreciation Using the 150 Percent Method. The extract of which can be seen in the below image from Audit Report of Reliance. Reliance uses the Straight Line Method of charging Depreciation for its certain assets from Refining Segment and Petrochemical Segment and SEZ Unit Developer.

8000 as the depreciation expense every year over the next ten years as shown in the. If the asset is not losing value in a steady manner. Cost of asset.

Depreciation Formula Example 1. Interest the expenses to a business caused by interest rates such as loans provided by a bank or similar third-party. The double declining balance depreciation method is one of two common methods a business uses to account for the expense of a long-lived asset.

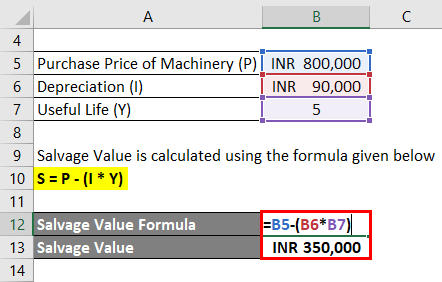

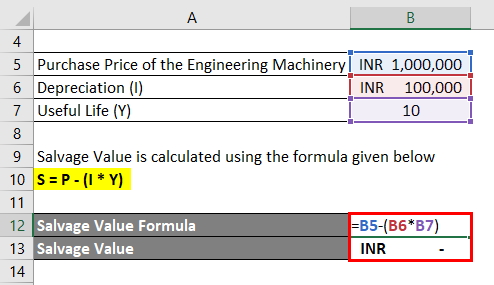

Example Suppose a manufacturing company purchases machinery for Rs. The difference using formula1 and formula 2 is because of some one-time expenses such as the acquisition of joint venture Joint Venture A joint venture is a commercial arrangement between two or more parties in which the parties pool their assets with the goal of performing a specific task and each party has joint ownership of the entity and is accountable for the costs. Profit before tax example.

Depreciation is calculated using the formula given below. Double declining balance method. We take an example of Reliance Industries Ltd.

The Calculate Depreciation batch job is run biannually. Its value indicates how much of an assets worth has been utilized. Double Declining Balance Depreciation Method.

Calculate the trucks depreciation for 2016 2017 and 2018. Example - Straight-Line Depreciation. Unit of production method if the machinery produces 16000 units in year 1 and 20000 units in year 2.

Depreciation Schedule Formula And Calculator

Salvage Value Formula Calculator Excel Template

Annual Depreciation Of A New Car Find The Future Value Youtube

Straight Line Depreciation Formula And Excel Calculator

Depreciation Formula Calculate Depreciation Expense

Depreciation Formula Examples With Excel Template

Depreciation Formula Calculate Depreciation Expense

Double Declining Balance Depreciation Calculator

Depreciation Rate Formula Examples How To Calculate

Depreciation Schedule Formula And Calculator

Depreciation Of Fixed Assets Double Entry Bookkeeping

Depreciation Calculation

Depreciation Formula Examples With Excel Template

Depreciation Rate Formula Examples How To Calculate

Depreciation Schedule Formula And Calculator

Salvage Value Formula Calculator Excel Template

Depreciation Rate Formula Examples How To Calculate